The UNCTAD (United Nations Conference of Trade and Development) has reviewed the performance of the maritime industry in 2020 and provides insights into how it fared in terms of various roll-on effects brought on by the COVID-19 pandemic and how it has persevered.

Whilst many braced for greater losses, comparatively the maritime industry in 2020 performed better in terms of volumes than expected. Apart from maintaining shipping volumes better than the lower numbers foreseen by experts, the pandemic also revolutionised the foundation of the global supply chain, bringing into question standard practices and trade patterns and shaken the way globalisation operates.

The first half of the maritime industry in 2020 saw struggles but the latter half saw recovery, pickup, and new strategies being adapted. The third quarter saw volumes pickup in container and bulk commodities trading. Overall volumes in maritime industry in 2020 was expected to drop by 4.1% in 2020, but in actuality, due to the rebound in adapting to the changes in the global trading and shipping market, they were able to lessen the fallout. As the COVID-19 pandemic occurred in phases, whether its from the lockdowns to the different mutations and the roll-on effect, the way it was handled, was also in due means. There was a greater surge of consumer purchasing, which kept volumes high though there have been great delays due to lessened staff caused by health regulations, lockdowns and bottlenecks in clearing goods at ports, the world has kept on going.

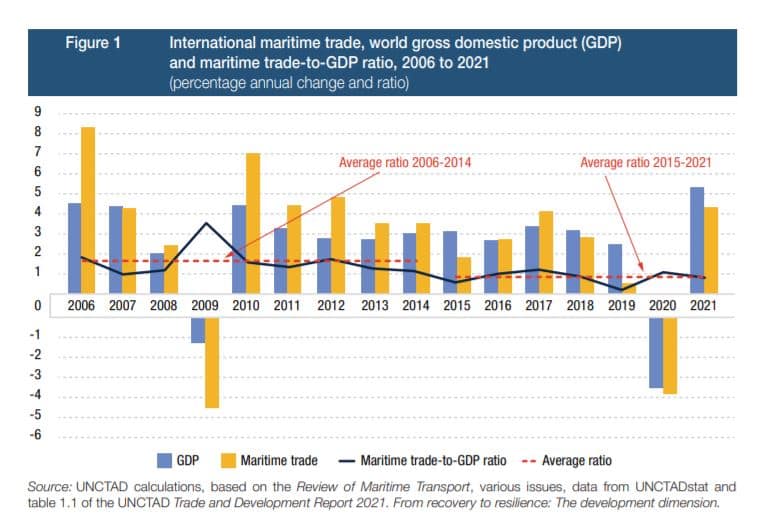

According to the UNCTAD Review of the Maritime industry in 2020, it is expected that the industry will increase by 4.3% as seen below.

Transco Cargo Australia – The UNCTAD Review of the Maritime Industry in 2020/2021

Yet, there have been great takeaways that need to be handled better in preparation for risk and crisis management in the future based on issued identified in the present crisis situation, that is, the COVID-19 pandemic. These include the following.

- Handling of seafarer welfare in terms of crew change and humanitarian crisis which was seen and brought on by the pandemic

- Tanker shipping was hardest hit compared to containerised trade, gas shipments, and dry bulk commodities mostly due to the lack of demand due to lockdown and travel regulations

- Logistics bottlenecks and rising costs have created uncertainty in the global economy

- Structural changes globally caused on by the impact of the global pandemic

- Supply and demand disparity

What were your takeaways and insights on the maritime industry in 2020 and how do you think 2021 will end in terms of global trade and shipping?